Good news, everybody! The markets are rebounding! Yes, we just a hit a minor bump in the road there, but don’t worry, everything is back to normal now.

Let’s forget about the tail end of last week and this week’s Black

Monday, shall we? Pay no mind to the uncomfortable low lights of the

global stock rout:

- The staggering $5 trillion wipeout of funny money paper promise “wealth” since the yuan deflation began ($2.7 trillion on Monday alone).

- The all-time record spike on the volatility index (aka the “Fear Index”).

- The 1000 point Dow plunge off the opening bell on Monday morning.

- The halting of every major US index during the market mayhem.

- The 4500 mini crash events that forced indices worldwide to halt and unhalt at a dizzying pace.

- The amazing magic levitating act courtesy of our friends at the Plunge Protection Team that brought about the largest intraday point swing in Dow history.

Nope, nothing to see here. And now that this dead cat bounce is underway, surely there will be no more commodity deflation or global economic slowdown or worldwide currency war orhistorically unprecedented bond bubbles to worry about, right?

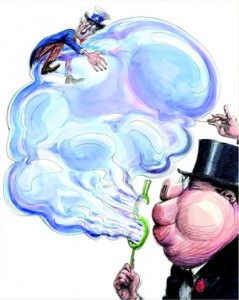

OK, enough sarcasm. Readers of this column will know by now that the

phony baloney stock markets, manipulated as they are from top to bottom

and juiced as they are on the Fed’s QE heroin, are no longer reflective

of economic reality. The only question is how far this particular dead

cat market will bounce, and whether it will be helped along with more

heroin from the Fed.

But there is already one vitally important take away from these

events that the independent media must articulate now, before it’s too

late. Namely: This crisis was engineered by the central banks. It is

their fault.

Let me repeat that again in case you missed it: This crisis was engineered by the central banks.